In investment banking, knowing the difference between the sell-side and buy-side industries is essential. But ironically, many of us are unaware of these critical terms. This article will look at the definition of the Sell Side and Buy side, their meaning, and the market players on each side.

Sell Side and Buy Side

Let us understand what the sell side and the buy side mean.

Sell-side in general, the primary thought coming into your mind will be that it is related to selling stuff, right? You are correct. The sell-side sells all sorts of securities, from stocks to bonds to options, on behalf of clients, and they sell it to the buy side. On the buy side, people are looking to invest money on behalf of investors, and they are typically buying securities, so the role of somebody on the buy side versus the sell side is quite different.

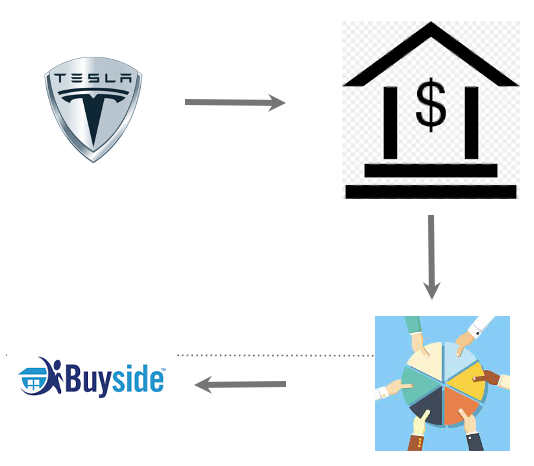

Let’s look at an example to make it clear. Let’s say Teslas’s looking to create another factory to expand into the electric truck market. To make this factory, they need money, so they’ll get in touch with somebody on the sell side, like an investment bank, to help them raise the money, and the investment banks might propose something like selling Tesla stocks to raise money.

The investment bank will then start pitching to the buy side, or the investors, on how exciting Tesla is and why they should invest in let us say the investment bank puts a price tag of $100 per Tesla share. So the buy side will hopefully get excited by this opportunity and decide to invest by buying 250 shares in Tesla. Tesla will receive the money from the investors, i.e., 250 shares*100 dollars = 25000 dollars in exchange for the shares, and for these services, the bank will take a commission to help Tesla raise the money.

So, in this example, the buy and sell sides depend on each other; if one of them is not doing well for whatever reason, then the other one is bound to suffer as well.

The buy side is about managing clients’ money, where they research how to invest, grow, or mitigate the risk while investing the money.

Buy-side

- Managing clients’ money – Investing money

- Getting returns

- Mitigating investing risks

While on the other hand, on the sell side, it is about raising money for companies or clients, in this case, by selling things like bonds, stocks, and other securities simultaneously. Another service involves advising clients, so these might be things like mergers and acquisitions.

Sell-side

- Raising money for clients

- Through stocks, bonds, etc., Advisory services

- mergers and acquisitions

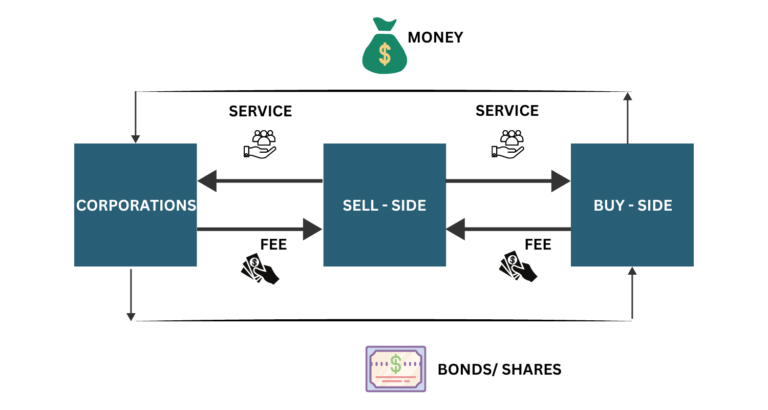

Rediscover how firms, buy-side, and sell-side firms work together in the capital markets. For simplicity, the involvement in capital markets is as simple as there are three parties. A party is a company seeking to raise funds by issuing securities. Second, the party with the money and who wants to invest in the company is called the buy side. The seller acts as an intermediary between the buyer and the business, advising on transactions between them.

Market Players

Let us see who are the market players on each side.

Reputable buy-side firms include private equity, hedge funds, mutual funds, exchange-traded funds (ETFs), venture capital, wealth management, and other mutual funds.

The most typical representative of the sell-side is an investment bank. Investment banks act as intermediaries connecting sellers and buyers in the capital markets by providing services to both sellers and buyers. In addition, other sell-side market participants include equity research, sales & trading, commercial banking, stockbrokers, and more.

Conclusions

Both sell-side and buy-side analysts are tasked with tracking and valuing stocks, but there are many differences between the two jobs. Always read and learn about the things and then take the necessary decisions.

I hope this article was useful.