MUTUAL FUNDS

“MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS. READ ALL SCHEME-RELATED DOCUMENTS CAREFULLY.”

The above is a universal term; everyone must have seen this while reading something or listening to the radio and television.

Every month when your salary is credited, you set aside a portion of your pay for savings. Savings can be used later for emergencies or if you want to buy a house, car, or any required thing. There are many ways to save money. A straightforward method is keeping your salary in the bank account, which gets collected. This is not the right way, as money loses its value as time passes due to inflation. Inflation is increasing in our country, and the process of commodities is rising too.

Consequently, according to the inflation rate, your money’s worth drops every year by 4%-5%. People invest the money so they don’t lose value. Investment can be defined as the application of money to earn more. Investment also means savings or savings made through delayed consumption, i.e., the acquisition of commodities that will be used to create wealth in the future but are not consumed today.

There are different types of Investment, and our country has mainly five places for Investment.

- Savings Account

- Fixed Deposits (FD)

- Gold and Jewellery

- Real Estate

- Stock Market

Any investment includes three essential things.

- Return

- Risk

- Time

- Return means the percentage of profit you earn through the Investment commonly seen in a portion. If our inflation rate is 4%, you should be able to see that your profit return is more than that. There is no advantage to investing money if the value doesn’t increase because inflation also increases.

- Risk refers to the danger of Investment and the likelihood of losing all of your money. What are the chances of losing money after investing?

- Time refers to how long you plan to invest. Time is mostly calculated in years.

Therefore, the main risk in this situation is that the return will also increase as time increases, as would the risk. You will need to take on greater risk and invest for a longer duration if you want a higher return on your Investment.

Savings accounts have the least amount of risk and have no restrictions. Anytime is a good time to save or withdraw money. And since our inflation rate has been between 4% and 5% over the past few years, the return we receive here is substantially lower, coming in at about 4%. Another less hazardous choice is a fixed deposit, but there is a time limit before we cannot withdraw the funds. Therefore the return is likewise 7-8%. These days, buying gold and jewellery carries significant risks due to the vast price fluctuations. Real estate and property investments are low to moderately risky. A large amount of capital to invest—between lakhs and crores of rupees—is one of the drawbacks of buying real estate. It requires a lot of money. You can make significant gains on the stock market but also suffer large losses. The stock you choose to invest in will determine the level of risk involved. You must be well-versed in both stock market operations and store performance.

So, these are the few types of investments that are widely used. But there are other types, too, such as Government bonds, Corporate bonds, Cryptocurrency and Bitcoins, and many more. A bit of well-known general advice is to never invest your money only in one place. We should diversify our investments so that you won’t be responsible for the total loss in the event of a crash. There is a much lower likelihood of everything collapsing, including the price of gold, real estate, and even the stock market. There’s a good chance that if one thing happens, you’ll also profit from the other. You need to invest in several locations; this is known as diversification.

One such tactic in the current world is investing in mutual funds. A mutual fund is a special kind of Investment that enables you to combine your funds across many asset classes.

A mutual fund’s past

The Indian mutual fund market officially began in 1963 with the founding of the Unit Trust of India. The public and private sectors now equally participate in this industry, which used to be dominated by UTIs. According to international standards, the Indian mutual fund industry is still relatively modest. Understanding how mutual funds operate is crucial because the total amount of money managed by the sector increased from $10 trillion in 2014 to $20 trillion in 2017, doubling in three years.

Let us understand this simple example:

Okay, let’s say I had to travel from Mumbai to Pune.

I have two choices.

- I can take my car out, I can drive by myself, I know how to drive so I can enjoy the journey, I can see which direction to go, I am aware of the fundamental driving rules, and I have a driver’s license. I am an expert driver. To put it briefly, I would conclude that I have a good education in driving. I can decide how to move, where to go, and how to cross.

- I don’t want to drive this two-hour trip alone; instead, I want to get to Pune securely, so I will hire a driver. In a nutshell, I employ a professional. He determines the route, how fast to go, and where to halt. I leave all final judgments in his hands. I only gave him the location of the finish line.

That is precisely the difference between a stock market investment and a mutual fund investment.

In the stock market, you make your own decisions, whereas, in a mutual fund, you hire a professional or expert in this field, and he makes decisions for you. Mutual fund management decides what to do with the money invested in the mutual fund. There are many types of mutual funds, accordingly, you can invest in any of these depending on your suitability.

Asset Management Company (AMC) starts mutual funds. You give your money to an asset management company and support all the money collectively at different places. The return rate they get collectively from these other places is that some small per cent of 1-2% is kept as a profit by the Asset Company, and the rest you get back as per that return rate.

ICICI, TATA, Reliance, HSBC, and Aditya Birla are a few examples of companies and banks that have started their Asset Management Companies. All the companies start different kinds of mutual funds in large numbers. For instance, ICICI began to have more than 1200 mutual funds.

So, how risky are your mutual funds, and the return depends on the mutual funds you are investing in?

Let’s examine the operation and purpose of a mutual fund.

Individuals like you and I will raise money for the mutual fund. Assume that a group of 100 individuals donate money or make contributions to mutual funds. This mutual fund will put the money back into investments like equities mutual funds, joint debt funds, and other similar options. In turn, mutual funds will generate income, which may come from dividends or interest. Let’s say mutual funds made 500 rupees; in this case, they would disperse the money to the investors who had put money into the fund. However, it’s vital to note that they won’t transfer the entire 500 rupees; instead, they’ll keep a piece of it as a commission.

The NAV refers to the mutual fund’s price per share (NET ASSET VALUE). The value of a fund’s assets less the value of its liabilities is known as net asset value (NAV). The value of the assets held in mutual funds is calculated using the phrase “net asset value,” which is frequently used in this context.

Because of this, you may have heard on the radio or in advertisements that your mutual fund investments would do the same if the stock market declined. (agar market girega to stock ki value bhi giregi)

NET ASSET VALUE = VALUE OF ASSETS – VALUE OF LIABILITIES

The NAV fluctuates based on the performance of the fund. Naturally, the price per unit of the mutual fund will alter if the asset invested grows. That is why it is said that “MUTUAL FUNDS ARE SUBJECT TO MARKET RISK. PLEASE READ THE OFFER DOCUMENTS CAREFULLY BEFORE INVESTING.”

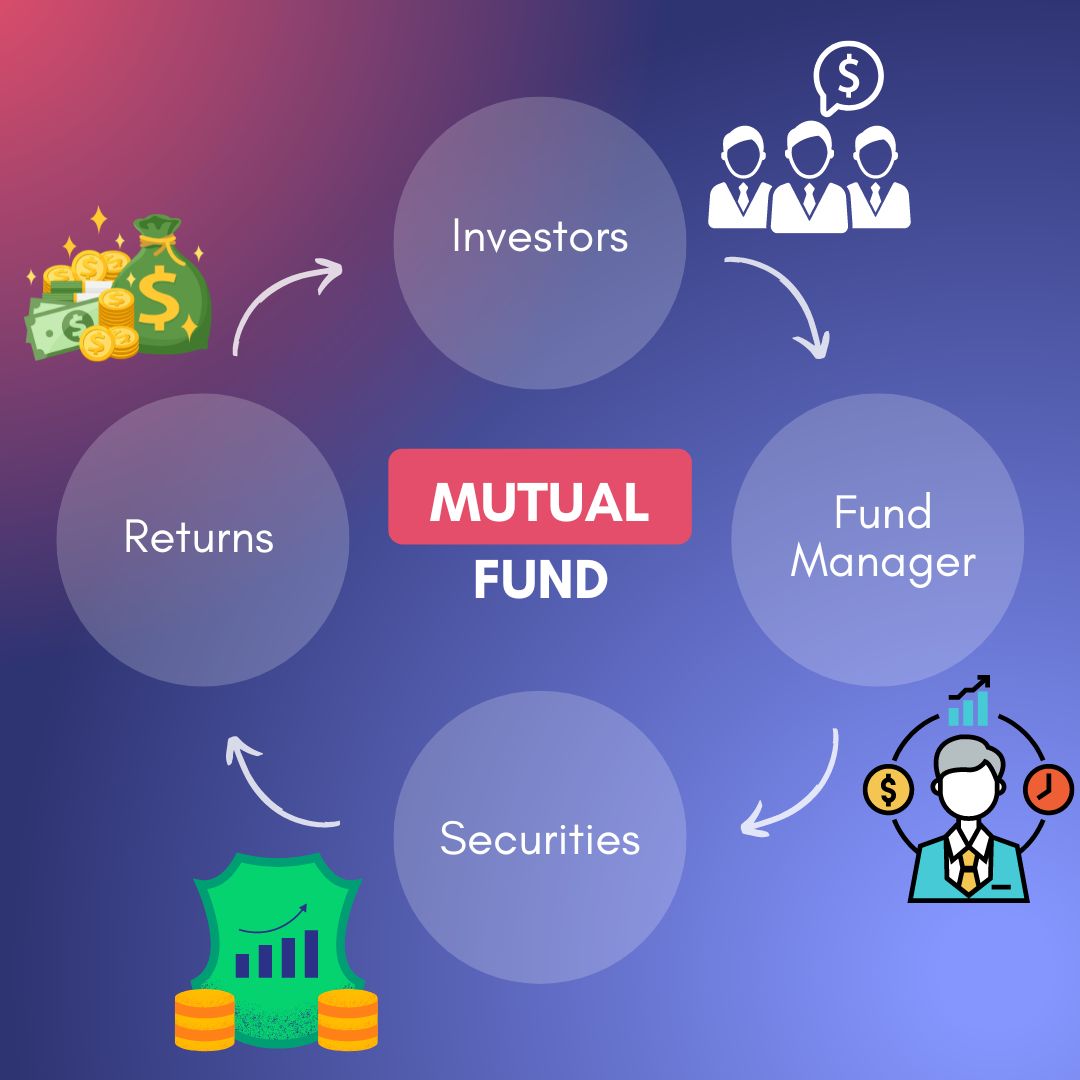

You can observe the cycle of mutual fund investors adding money to the funds. After that, the mutual fund reinvests this money into various securities. They produce this way, then given to the investors who initially put their money into mutual funds.

How do mutual funds make money for themselves?

As previously said, they will not provide the investors with the complete sum. The amount they keep for themselves is the expense ratio.

What does an Expense Ratio mean?

In its simplest form, the expense ratio refers to the charges a mutual fund assesses to manage your money. In a nutshell, this means that they receive a commission. By dividing a fund’s operating costs by the average dollar amount of its managed assets, an expense ratio is calculated (AUM). This expense ratio comes directly out of your pocket because it is deducted from the pool of created funds. It varies between 1 and 3 per cent. Although this 1 to 3 per cent doesn’t seem like much, it might mount up over time.

Let’s use an illustration to grasp this better.

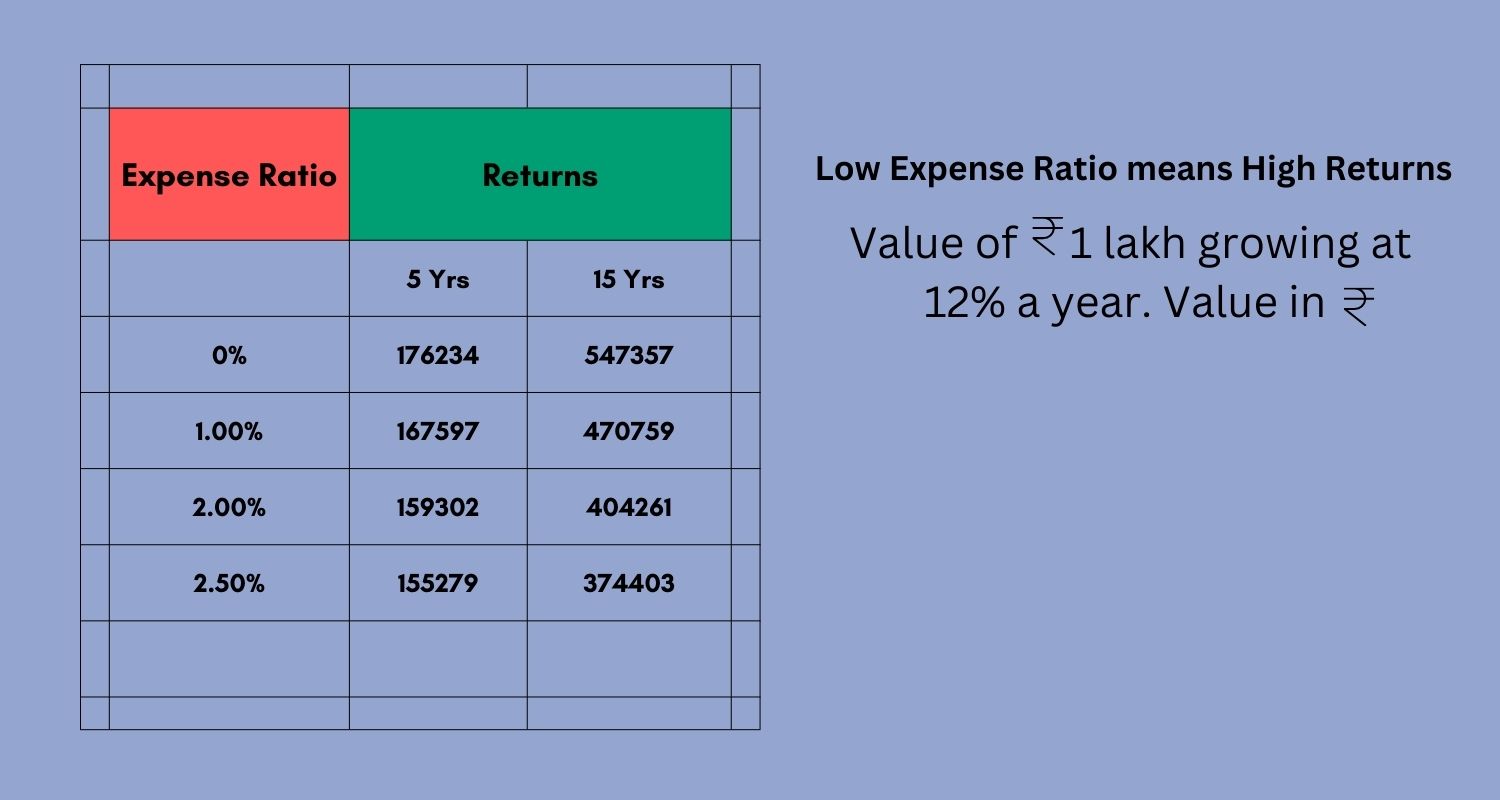

If you put one lakh in mutual funds with a 12% return and a 0% expense ratio, you will have rupees 1,76,234 after five years and 5,47,357 after fifteen years.

You would have invested in mutual funds at a 2.5% expense ratio if the amount was one lac; 2.5% seems excessively small in our country.

However, comparing the returns, you would receive 1,55,279 after five years and 3,74,403 after fifteen years—almost a 1,72,954 difference.

This figure on your paper appears exceptionally modest, but it could significantly influence your Investment over time.

Two different sorts of mutual funds based on the fees they charge

- Direct plan: There is no distributor to help with the transaction; an investor must invest directly with the AMC.

- Regular plan: An investor invests through an intermediary, such as a distributor, broker, or banker, who receives payment from the AMC through a distribution fee that is added to the plan.

Advantages of Mutual Funds

- The fact that mutual funds are already diversified gives them a significant edge over other types of investments. Through diversity, your risk decreases dramatically.

- Another benefit is that it is reasonably priced; overall, you won’t have to make a significant investment.

- A specialist known as a fund manager manages all of your investments in mutual funds, deciding where to put your money and where it should not go.

Disadvantages of Mutual Funds

- A disadvantage is that you can’t fully trust the individual with your money because you’re entrusting them to invest it on your behalf.

- In the past, brokers would receive a large commission for selling mutual funds.

Conclusion

Investing is a smart way to put your money to work and could make you richer. Investment plans help people invest regularly and systematically in a variety of wealth-building possibilities in order to achieve their long-term financial goals. One such investment is the use of mutual funds. Compared to the stock market, gold, real estate, and mutual funds are less hazardous. However, the precise risk will differ based on the mutual fund you choose to invest in. Additionally, you have a mutual fund professional working for you, which is advantageous for both parties. Nevertheless, all investments carry some level of risk. Make sure you understand why you are investing before you begin. This will enable you to identify your investment objectives and create an investment strategy that supports them.