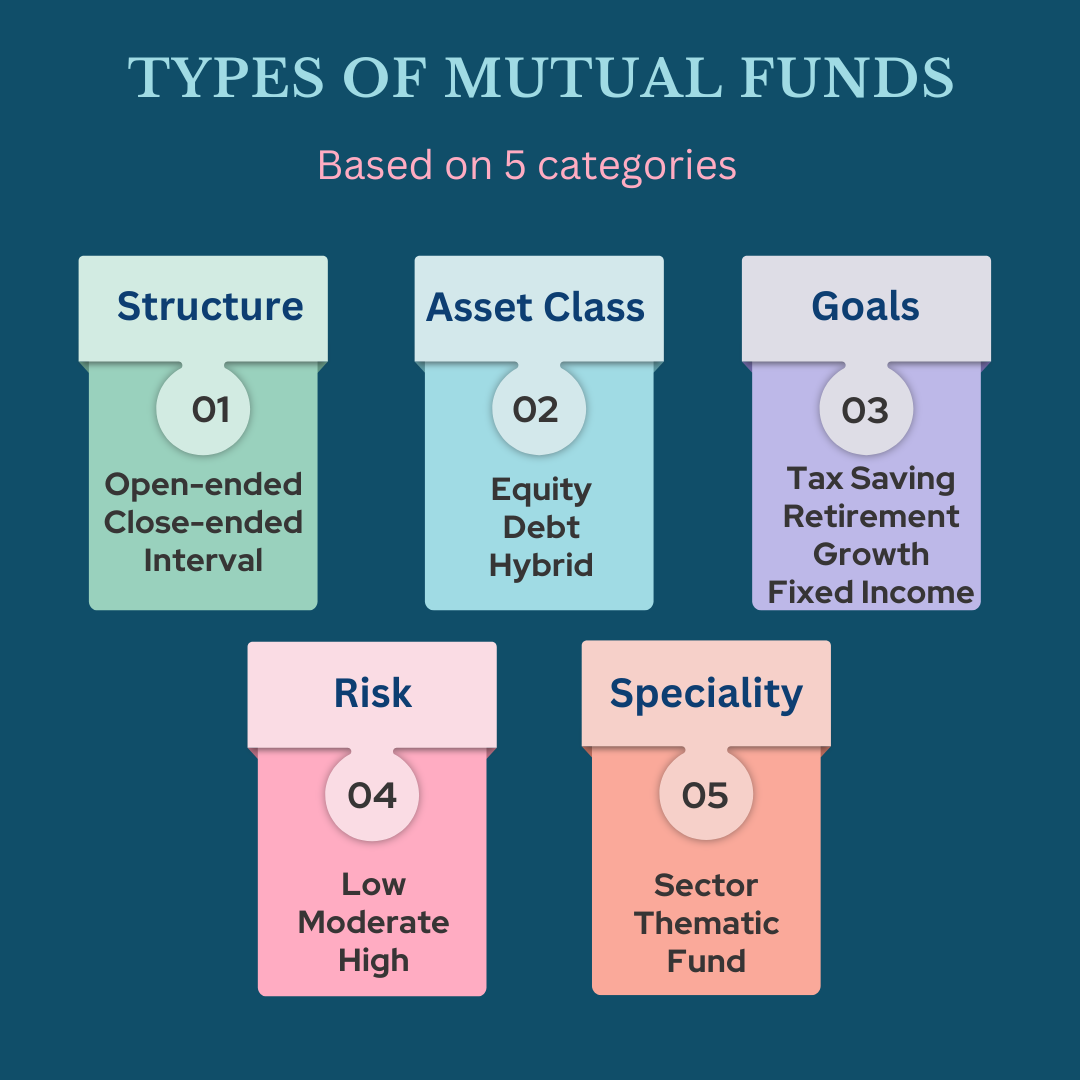

Types of Mutual Funds

As an investor, you must be aware of these particular mutual fund schemes because whenever you invest in any mutual fund, you know that it is subject to risk. After all, it is linked to investment in marketable securities. You need to consider your risk appetite, and your investment objective, and you must be aware of all the types of mutual funds so that you can choose the appropriate one as per your demand and your investment goal.

Types of Mutual Funds based on Structure:

Open-ended Fund

Investors may enter or depart open-ended schemes anytime, even after the NFO. When an AMC, or Asset Management Company, launches a new mutual fund scheme open to investor subscription, that period is known as the new fund offer period. AMCs can be any bank or financial organization. You can invest in a new mutual fund scheme within that period, but you can still enter or exit that particular scheme at any moment if you still wish to do so after that term has passed. It is called an “open-ended fund” because of this. The open-end plan continues to operate with the remaining investors, notwithstanding the possibility that some unit holders will withdraw all or part of their holdings. There will be numerous investors in one specific mutual fund plan. These investors’ money will be placed in that typical mutual fund scheme. Even if some investors have sold their mutual fund schemes and redeemed them, or if they went for redemption, those mutual fund teams will still be able to operate. These funds are referred to as open-ended funds because there is no set deadline by which they must be closed.

Close-ended fund

The maturity of closed-end funds is set. Only during the NFO can investors purchase units of a closed-end scheme from the fund. We discovered that open-ended funds allowed investors to buy or sell mutual fund units even after the NFO, but close-ended funds only allow this during the NFO. When a new fund scheme (NFO) enters the market, it is initially available for mutual fund scheme acquisition or sale; however, after that, these close-end schemes are terminated and listed on the stock exchange. If you own a closed-end fund and wish to redeem your investment, subscribe to a specific plan, or buy or sell a mutual fund scheme, you must go to the stock exchange and conduct your trading there. Closed-ended funds are, therefore, only accessible during the NFO or the new fund offer period, after which it becomes listed on the stock exchange. If investors are available, you can trade as an investor by buying and selling if the fund is listed on one or more stock exchanges, which is required for close-ended schemes. Because you cannot buy or sell from a mutual fund scheme once they close, listing these funds on stock exchanges is required. A platform where trading may take place becomes essential, which is why it is listed on the stock exchange, where you can easily trade where you can, buy or sell your mutual fund units, the units of closed-end funds that you own.

Interval fund

The advantages of both open-end and close-end funds are combined in interval funds. They are primarily close-end but may switch to open-end. The interval period between two consecutive transaction periods, or when the fund closes and reopens for buy and sell, is known as the interval period. The minimum interval period length is 15. Therefore it will remain closed for 15 days. The interval period is not a time for subscription and redemption. When a mutual fund scheme is closed or during the interim period, you cannot purchase or sell any units of the mutual fund scheme. Because of this, you must wait until the moment when it will once again become the open end for a set amount of time before you can sell your scheme or purchase any new plan.

Types of Mutual Funds based on Asset Class:

Equity Fund

The fund that invests in equities and equity-related instruments is called an equity fund. Your investment will consist of more than 65% equity instruments. Examples include small-, mid-, and large-cap equity funds, which invest in company shares based on market capitalization. Therefore, whenever you hear the terms “small cap fund,” “mid-cap fund,” or “big cap funds,” you should know that these terms refer to funds that invest in firms with correspondingly small, medium, and large market capitalizations. The market capitalization of a publicly traded company is determined by multiplying the total number of shares by the share price.

As a result of the higher risk associated with these funds compared to other, safer instruments, investors also expect more significant returns. Diversified equity funds, targeted equity funds, and sector funds are a few different types of equity funds.

Debt fund

A debt fund is a fund that invests in debt and securities that are related to debt. As a result, a large majority of the investment amount—more than 65 per cent—will be invested in debt and instruments associated with debt. When compared to equities, debt instruments are safer, less risky, and hence have lower returns. Liquid funds, money market funds, overnight funds, short-term funds, bond funds, guilt funds, etc., are a few of the debt schemes.

A brief introduction to liquid funds and open-ended liquid schemes is that they invest in debt and money market assets with maturities of up to 91 days. Overnight fund schemes invest in short-term securities with a one-day maturity. Government securities are a significant investment of guilt funds. These funds have an average return and are for shorter durations in safer instruments.

Hybrid fund

Hybrid funds invest in a blend of equity and debt instrument. Some people prefer to strike a balance between the two; they don’t want to take on more risk and settle for lower returns, so they choose a balanced fund. One of them is the hybrid fund. In both asset groups, there is a proportionate amount of investment. Conservative, balanced, and aggressive hybrid funds are additional categories for hybrid funds. A traditional hybrid fund will invest between 75 and 90 per cent in debt instruments. Equity and debt investments in balanced hybrid funds will be roughly equal, ranging from 40 to 60 per cent. The investment in equity instruments in an aggressive hybrid fund will be made on a larger scale. Thus it will be between 65 and 70 per cent.

Types of Mutual Funds based on Goals:

Tax Saving Fund

You can select a mutual fund strategy based on your desired investment outcome. If you don’t want to pay a lot of taxes, you can decide to put money into a program that also offers you a way to reduce your tax obligations. Therefore, mutual funds provide tax-saving programs that give investors a return and a tax benefit. Under section 80C of the income tax code, investments made in tax-saving mutual funds are eligible for tax breaks. Many tax-saving investments are accessible and will give you tax benefits, including section 80C tax deductions. Equity-linked savings schemes, or ELSS, is one type of tax-saving fund.

Retirement fund

Retirement funds invest heavily in low-risk investment options like government securities to achieve a constant and consistent return. If you wish to invest in a retirement fund, you need to ensure that your money has been invested over time and that you will receive a pension from that fund once you have reached retirement age. These mutual fund programs invest in less risky assets like government securities to ensure your safety, prevent the loss, and give you a reasonable average return for your pension after retirement. Investors put money into retirement funds to get a regular income after retirement. Retirement funds typically have a lock-in period of around five years or until your chosen retirement age.

Growth Fund

Growth funds’ diverse portfolio comprises stocks of rapidly expanding businesses. These funds’ primary goal is to promote capital appreciation; as a result, they pay minimal to no dividends. These investments carry a high risk but huge potential reward. Since most of the money is reinvested, there is little to no dividend. Example: The Bluechip Fund, which invests in the majority of well-known and expanding businesses.

Fixed Income Fund

These funds invest in safe assets like bonds, debentures, and money market instruments to deliver consistent cash flows to their owners through interest and dividends at predetermined intervals. These are the funds that will give you consistent cash flows. Some people wish to make money consistently. Fixed-income funds are a good option for them, for example, Monthly Income Plan.

Types of Mutual Funds based on Risks:

Low-Risk Fund

With an average return of roughly 6-7%, low-risk funds are debt-oriented with low risk to protect the invested capital. Your risk tolerance will determine the amount of financing you receive. You might be a risk-averse investor, so you don’t want to take more significant risks because you’re worried about losing your money. You also can’t take too much trouble because you have a family to support and less investable money to lose, which is why this fund is employed. Examples of low-risk funds include Guilt Funds which invest in government securities, debt instruments, and money market products like call money, certificates of deposits, treasury bills, etc.

Moderate Risk Fund

A balanced mix of investments in debt and equities are offered by moderate-risk funds, which also offer returns of between 8 and 10 per cent. Investors willing to take some risk but don’t want to suffer significant losses often choose moderate-risk funds since they invest in markets with a balance between debt and equity funds. This is because a portion of the investment is made in debt and equity instruments, which yields an average return of between 8 and 10 per cent. Hybrid funds, conservative funds, balancing funds, etc., are examples of moderate-risk funds.

High-Risk Fund

Young people without dependents who desire to expand their money through capital appreciation choose high-risk funds and invest in them. With the primary investment goal of growth and capital appreciation, these funds invest primarily in equities and equity-related assets. The investor’s expectation of return will be higher for funds mainly invested in equity due to the increased risk involved. Still, it’s not sure that you will receive a higher return. It has a solid connection to the market. It is advised that whenever you invest in high-risk or equity funds, you should invest for a good period of 5 to 10 years because that period will be required you to go through all the market cycles. If the market is in your favour, you can expect a good return, but if the market is going down, you will also be experiencing losses. Investing in high-risk funds is always advisable for a more extended period because market fluctuations in a shorter time will not give you a reasonable average return. The market may be down, up, and down again, so it fluctuates, but over time it will grow and give you a good return.

Types of Mutual Funds Based on Speciality:

Sector Fund

An open-ended equity fund, a sector fund, invests in a particular industry, such as banking, energy, infrastructure, pharmaceuticals, technology, and real estate. These funds make investments in a single drive. As a result, you decide to participate in a sector fund that would invest in the banking sector after noticing how well the banking sector is performing as an investor. These sector funds will select one specific industry and invest only in that sector. These sector funds are riskier since losses could be significant if the industry in which the investment is made performs poorly. All investments are made in a single sector; if that industry collapses, your money will be lost, but the economy will expand if that industry functions exceptionally well.

Thematic Fund

Thematic Fund makes investments based on themes. These funds make investments in a variety of industries that are related to a similar thread. Thematic funds are sometimes mistaken for sector funds, but they are distinct. Thematic funds concentrate on several sectors relating to the specific topic of a given mutual fund scheme, whereas sector funds focus on just one specific area. An infrastructure-themed fund, for instance, would invest in the stock of businesses engaged in building infrastructure, steel, telecom, power, cement, etc.

Fund of Funds

An open-ended fund or fund scheme is a “funds of the fund” investment in an underlying fund. These mutual fund schemes will invest in other mutual fund schemes; therefore, a fund that invests in another is referred to as a fund of funds. The underlying fund’s minimum investment is 95 per cent of its total assets, which is a sizable sum.

Conclusion

Choosing a mutual fund that best meets a client’s unique investing goals can be challenging because there are many different types of mutual funds on the market. The most straightforward advice is to start by recognizing your wants. The following stage would be to determine your goal. Is the goal to accumulate wealth rapidly, gradually, or rapidly? The risk you are willing to take should be the last important factor to consider once that has been decided. According to general observation, the funds with the most considerable risks typically give the highest returns. Therefore, that fund should be chosen if you want returns rapidly and are willing to face risks. Investing in a medium- or low-risk mutual fund is best if your goal is to develop money gradually.

Investors must carefully study their policy documents before investing because mutual funds always carry some risk, no matter how little. Reading the contract would also be a good idea to make sure that the investors clearly understand what they have purchased and all the amenities that come with it.